Just wanted to make a post about Lululemon, seeing as this stock is tanking like an unstoppable brick at the moment. Quick note: I don’t own Lululemon and have no plans to buy it, which I’ll explain further. However, for anyone who does own Lululemon, I want to provide some perspective and caution against panic selling during this seemingly unending fall.

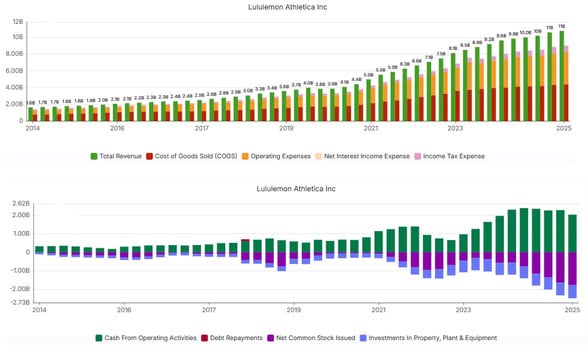

Lululemon is a premium athletic apparel company that sells primarily direct-to-consumer through its own stores and e-commerce, giving it control over branding, pricing, and margins. Known for high-quality, proprietary fabrics and stylish, functional designs, the brand positions itself as a lifestyle rooted in wellness and community rather than just a product line. Its strategy focuses on premium pricing, deep customer loyalty, and minimal wholesale distribution, while driving growth through men’s wear expansion, international markets—especially China—digital sales, and diversification into fitness technology and subscription content. Over the past 20 years, Lululemon has compounded revenue growth at an astonishing 28% annually, and operating cash flow at 27%—truly insane numbers. Growth has slowed in recent years, but the company still maintains a consistent ~10% annual growth rate.

Why the Fear?

Lululemon’s stock has been under pressure due to several near-term challenges: slowing U.S. sales and weaker store traffic, potential profitability erosion from new tariffs (30% on goods from China and 10% on others), brand dilution risks from product missteps such as overly bold colors, excessive logos, and stockouts of key items, and intensifying competition from rivals like Alo Yoga and Vuori.

Another major concern is the lawsuit against Costco, alleging that the retailer sold knockoff versions of Lululemon apparel—like Scuba hoodies, Define jackets, and ABC pants—under the Kirkland brand and others. The lawsuit claims trade dress, trademark, and design patent infringement, seeking a jury trial, sales halt, and damages. I believe this is a case Lululemon may not win, and it has publicly highlighted that its designs can be replicated. Overall, I think this has just been bad press for Lulu as it made shareholders fearful about their competitive advantage.

Breaking Down the Facts

Despite the lawsuit highlighting that Lululemon’s designs can be copied, the reality is that people are still buying its products. Revenue continues to grow at ~10% annually, free cash flow is stable, and earnings are at all-time highs. Fundamentally, the company remains strong, and these fears seem irrational.

Additionally, as the stock price has dropped, Lululemon has been directing a growing portion of its cash flow into share buybacks at cheap valuations. This is an excellent sign of capital allocation and show managements aim is to create shareholder value. Currently, the stock trades at its lowest P/E since the 2008 Global Financial Crisis, with shareholders pricing in essentially 0% growth, while the company continues producing 10% annual growth and buying back shares. Selling now would likely be at the worst possible price.

Why I’m Not Buying

When I look at Lululemon, I see a company that has been managed exceptionally well to grow its brand. However, I find it hard to understand if they have a moat or a competitive advantage. Generally, I find brand moats the hardest type of moat to assess, and I avoid trying to make calls on them. For me, there are other companies in the market that I understand better and would rather put my money into; this is the reason why I likely won’t pick up Lululemon. However, just because a company may not have a moat, that doesn’t mean it won’t continue to grow and do well.

Summary

Despite all the fears, Lululemon continues to perform fundamentally, management is taking advantage of cheap buybacks, and the stock is at all-time low valuations. I can’t recommend buying a stock I wouldn’t buy myself—each investor must make this decision of their own—but this post is a reminder: don’t get swept up in market panic, focus on fundamentals, review your valuation and expected returns, and stay rational.

Safe investing all!

i considered it as a vanity moat. I wonder if RACE has a better vanity moat than LULU.

If it helps anybody, I just read the Lululemon write up by MorningStar. They feel that Lululemon has a narrow economic mode and that it’s fair value estimate is near $300 a share.  the nov 2025 $150 puts are nearly $5. Seems like a pretty good premium? What do you all think?

Excellent analysis and charts. Which software do you use for chart creation?

Interesting stock, thanks for the post. This is one of those companies I’ve always thought I would not buy, simply because I really just do not understand it. Does it have a MOAT? honestly, I wouldn’t have a clue, but I can see if you have confidence, it could be a value play right now.

There’s a McDonald’s right down the street, I go there occasionally for convenience and get two spicy mcchickens from the value menu. Everything else feels like a rip-off, I can get much better quality for the same price elsewhere. Yet every time I go the place is at like 60% capacity, which seems like a sweet spit – not uncomfortably packed like In-n-out, but not Del Taco empty. It seems especially popular with teenagers. So despite my skepticism, McDonalds is definitely doing something right. Do they have many international growth opportunities left?

I just brought a position in to it but I could regret it massive PEG could end up being a trap 🥴 FOMO while building my equity bonds portfolio.

Equity Crate MCD is one that’s really done something I don’t think anyone could of expected. Revenue growth has been basically stagnant over the last 10 years, however MCD has exercised pricing powers to perfection, expanding margins like never before in their history. However, when growth only comes from margin expansion, there comes a point where it will slow down. What’s your assessment of the value on MCD based on this moving forward?

I buy Mcdonalds share when it dips. I’m patient and in the long term Mcdonalds recovers. Good to average in on this stock.