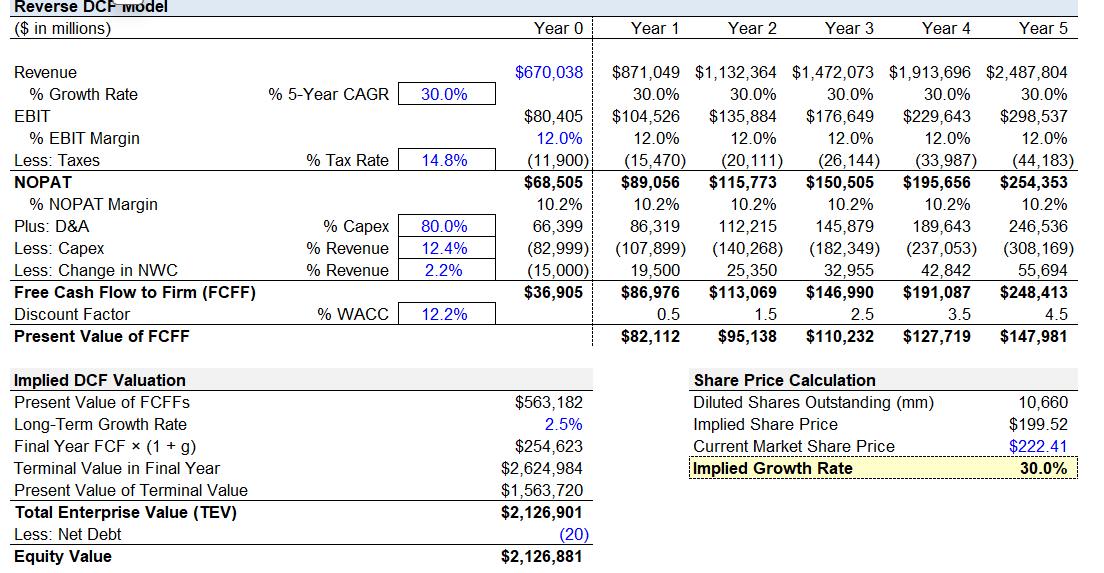

I am trying to analyze the AMZN stock using a Reverse DCF model.

Basically, I am trying to figure out what is the expected revenue growth needed to see my stock price go from $222 to $300.

Historically, its revenue growth rate is around 12%.

But for it to reach $300, it needs to have a revenue growth of 42%!

If anything its showing me that the current market price (which has been a very low performance YTD) AMZN stock is overpriced.

If anything its showing me that the current market price (which has been a very low performance YTD) AMZN stock is overpriced.

Your thoughts?

—

We already know that stock market is disconnected from reality. Not surprised that Amazon which is considered too big to fail follows that trend.

Well, Charlie used to say he never seen buffett use DCF. I guess the projection for each items in cash flow seems to be the problem.

No quant based model will work on a stock like AMZN.

You are directly equating revenue growth with share price change, but a stock’s valuation depends on free cash flow to the firm (FCFF) and discount rates, not just top-line revenue.

Thus, saying “it needs revenue growth of 42% to reach $300” oversimplifies the valuation mechanics.

Suggest adjust WACC to 9% and EBIT margin to 15% and rework your model.

.. if Amazon’s cost of capital is closer to 9% (typical for large-cap tech) and it can raise EBIT margins to 15%, the required revenue growth to justify a $300 share price would fall from 42% to around 28–30%.

Kuiper… is what you’re missing. although second mover to Starlink, will be a huge growth engine for access, content, & overall global expansion.

Historic anything can be a good indicator for future? My common sdnse says no.

AMZN stock is trailing the major indexes for a 5-year period. The market knows something we do not.